Finezza Reporting & Analytics

Complete Lending Visibility with

35+ Pre-Built Reports

Comprehensive reporting suite covering every aspect of your lending operations - from cash flow tracking and portfolio analysis to risk monitoring, accounting reconciliation, and regulatory submissions.

Get real-time dashboards with customisable filters for data-driven decision making across all lending products.

35+ Pre-Built Reports Across All Lending Operations

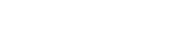

Cash Flow & Transactions

Loan Inflows Report

View all loan payments received in a given time period with complete transaction details, payment modes, and inflow types.

Loan Inflows Audit Report

Comprehensive audit of loan payments with principal, interest, charges, penalties, TDS, and overflow credit reconciliation.

Disbursement Details Report

Track disbursements with processing fees, GST components, insurance, upfront interest, and net disbursement calculations.

Loan Outflows Report

Monitor all loan disbursements, insurance payments, and other outflows with complete transaction documentation.

Loan Wise Monthly Collection

Monthly collection tracking across loan products with detailed breakdown of principal, interest, charges, and penalties received.

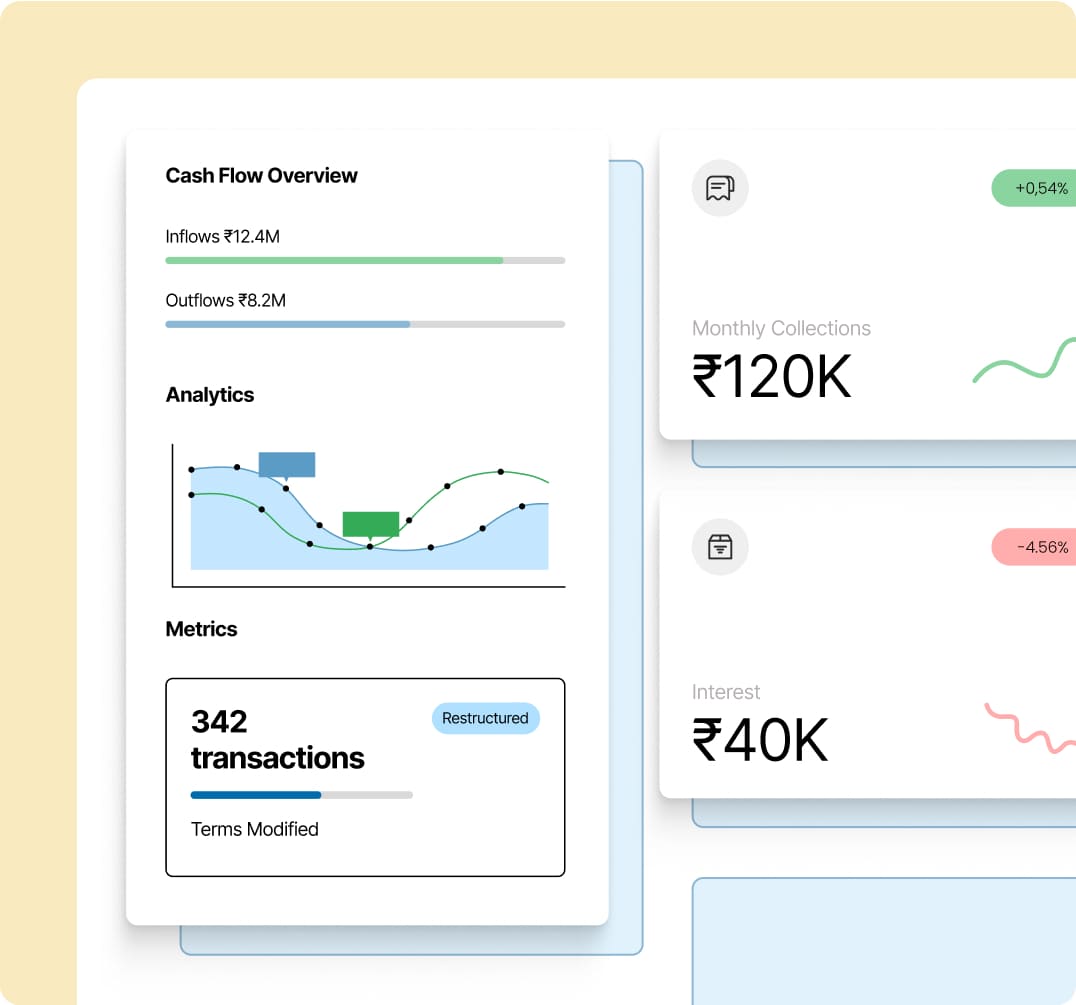

Portfolio Management

Loan Details Report

Complete breakdown of all loans with status tracking, restructuring history, settlements, and write-offs for comprehensive portfolio oversight.

Loan Characteristics Report

Detailed loan analysis including sanctioned amounts, interest rates, tenure, repayment frequency, and disbursement details.

Loan Portfolio Report

As-on-date portfolio behavior since inception with DPD/bucket-wise analysis in ALM format required by investors, bankers, and auditors.

Loan Book Report

Master MIS report for loan book analysis including borrower demographics, PAN, Aadhaar, and complete contact details.

Loan Principal Outstanding Report

Track principal outstanding for overdue loans with borrower information, loan status, city, state, industry, and DPD tracking.

Risk & Overdue Management

Overdue Loans Report

Review overdue loans with DPD tracking, principal and interest overdue amounts, penalties, and complete borrower profiles.

DPD Behavior Report

Analyse DPD profile of overdue loans including peak DPD, DPD instances, and behavior type classification for targeted strategies.

DPD Movement Between Dates Report

Track DPD movement over time with bucket transitions, amounts collected, and recovery performance metrics.

DPD Bucketwise Movement Report

Calculate amounts required to move loans between DPD buckets for optimized collection planning and resource allocation.

Instalment Due Report

Track past installments and generate future projections for accurate liability reporting and liquidity planning.

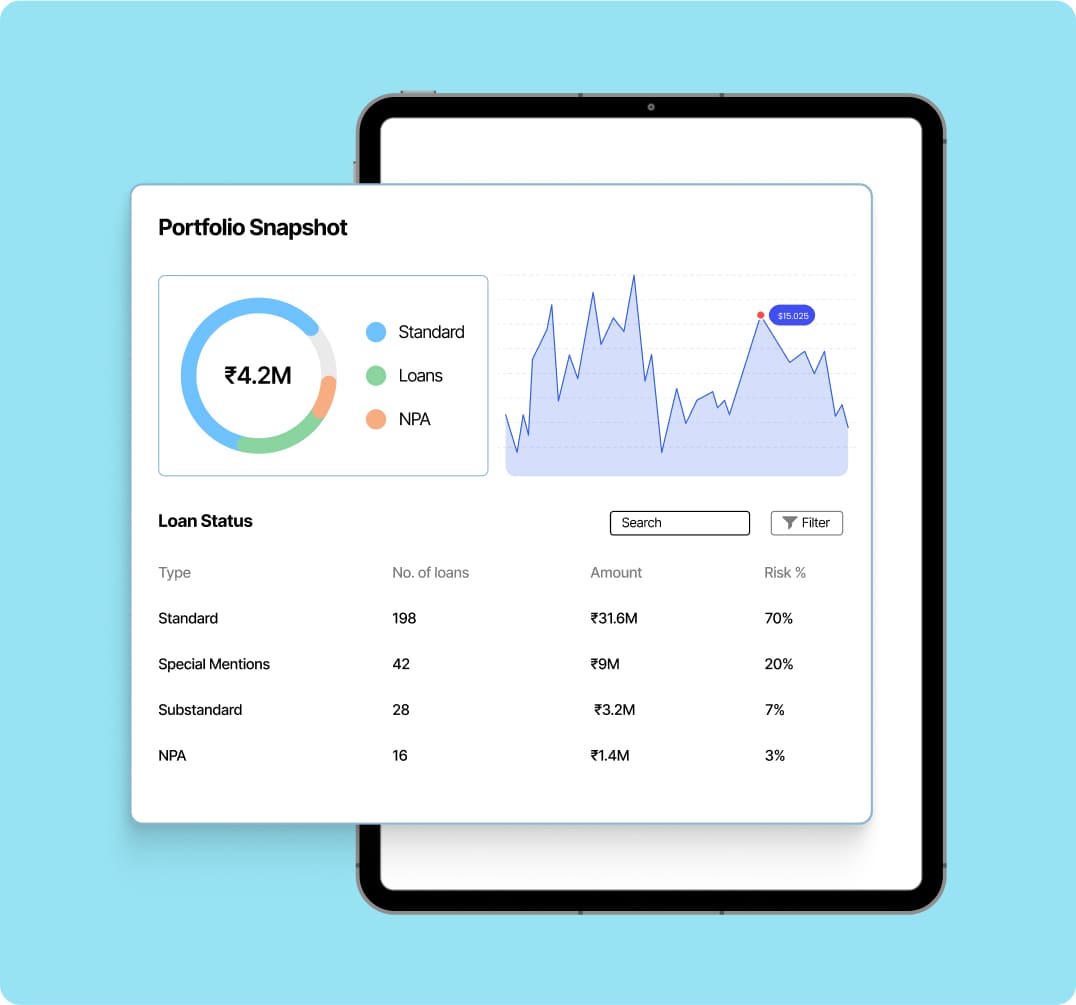

Accounting & Regulatory Compliance

Journal Entry Report

Complete journal activity tracking for reconciliation with accounting systems, including GL codes, debits, credits, and transaction details.

Trial Balance Report

Sum of debits and credits for every account on accrual basis, ensuring account balance and accurate financial statement preparation.

Accruals Report

Track accrued interest for accounting purposes with integration capabilities for accounting software updates.

Credit Bureau Report

Generate credit bureau submission reports for all major bureaus with standardized data formats ensuring regulatory compliance.

Writeoff Report

Complete writeoff tracking including principal, interest, charges, penalties, and delayed interest for regulatory reporting requirements.

Loan Approval Report

View all loan and drawdown approvals raised in the system with approval status tracking and workflow monitoring.

Co-Lending Disbursements & Outflows

Co-Lending Disbursement Report

Review aggregate disbursements with co-lender wise split showing gross and net amounts for primary lender and partners.

Co-Lending Disbursement Summary Report

Monthly disbursement trend analysis at aggregate and co-lender level for partnership performance tracking.

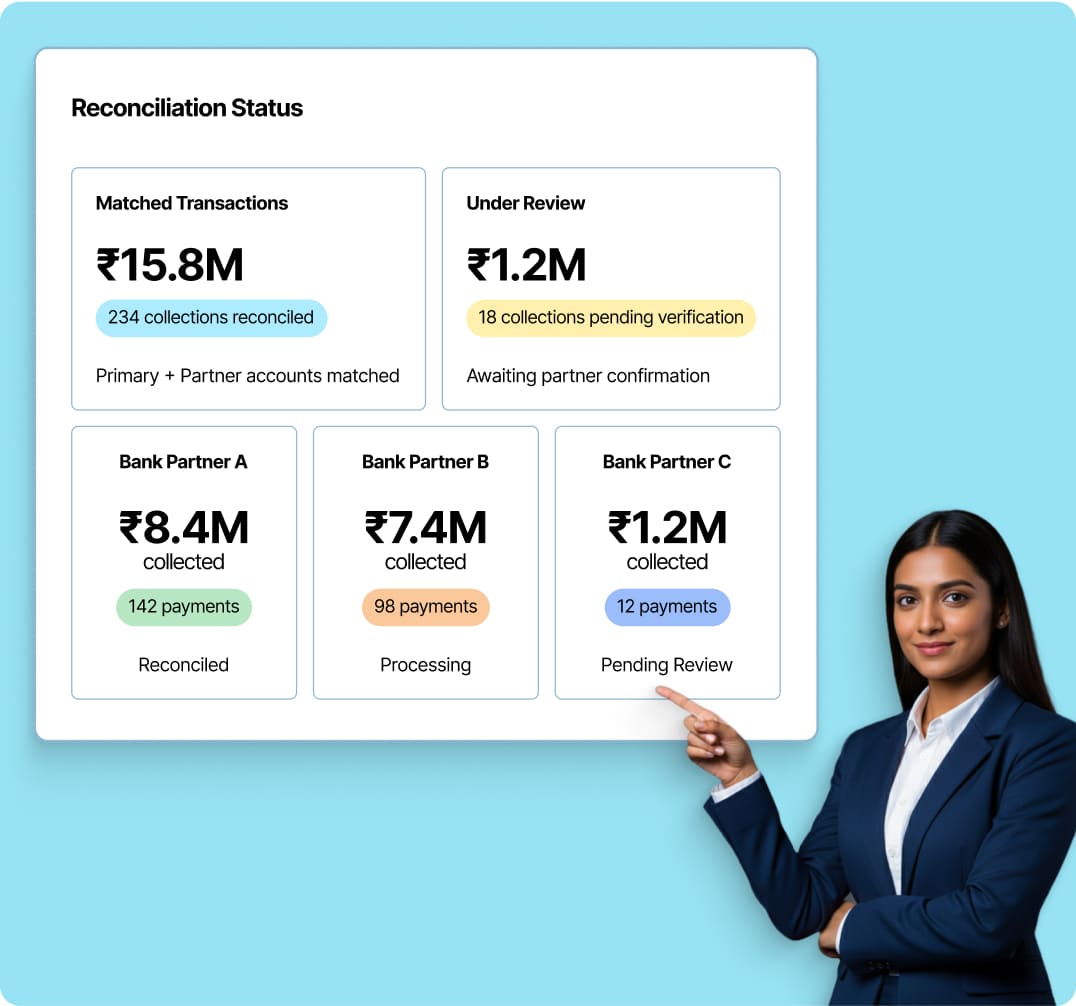

Co-Lending Outflows Reconciliation Report

Reconcile outflows with primary lender and co-lender bank account statements for accurate partnership accounting.

Co-Lending Inflows & Outflows Report

Comprehensive transaction reconciliation report covering both inflows and outflows with complete partner-wise splits.

Co-Lending Loan Portfolio Report

Monitor monthly portfolio trends including loan balance, delinquency ratios, portfolio-at-risk, and loan loss rates across partnerships.

Co-Lending Collections & Reconciliation

Co-Lending Collections Report

Track collections received with complete breakdown of amounts across primary lender and co-lending partners.

Co-Lending Inflows Summary Report

Review monthly payment trends at loan product and co-lender level for partnership performance analysis.

Co-Lending Inflows Reconciliation Report

Reconcile inflows with primary lender and co-lender bank statements ensuring accurate partnership settlement.

Co-Lending Portfolio at Risk Report

Monitor portfolio risk with days overdue analysis, borrower counts, arrears percentages, and outstanding balance distribution across partners.

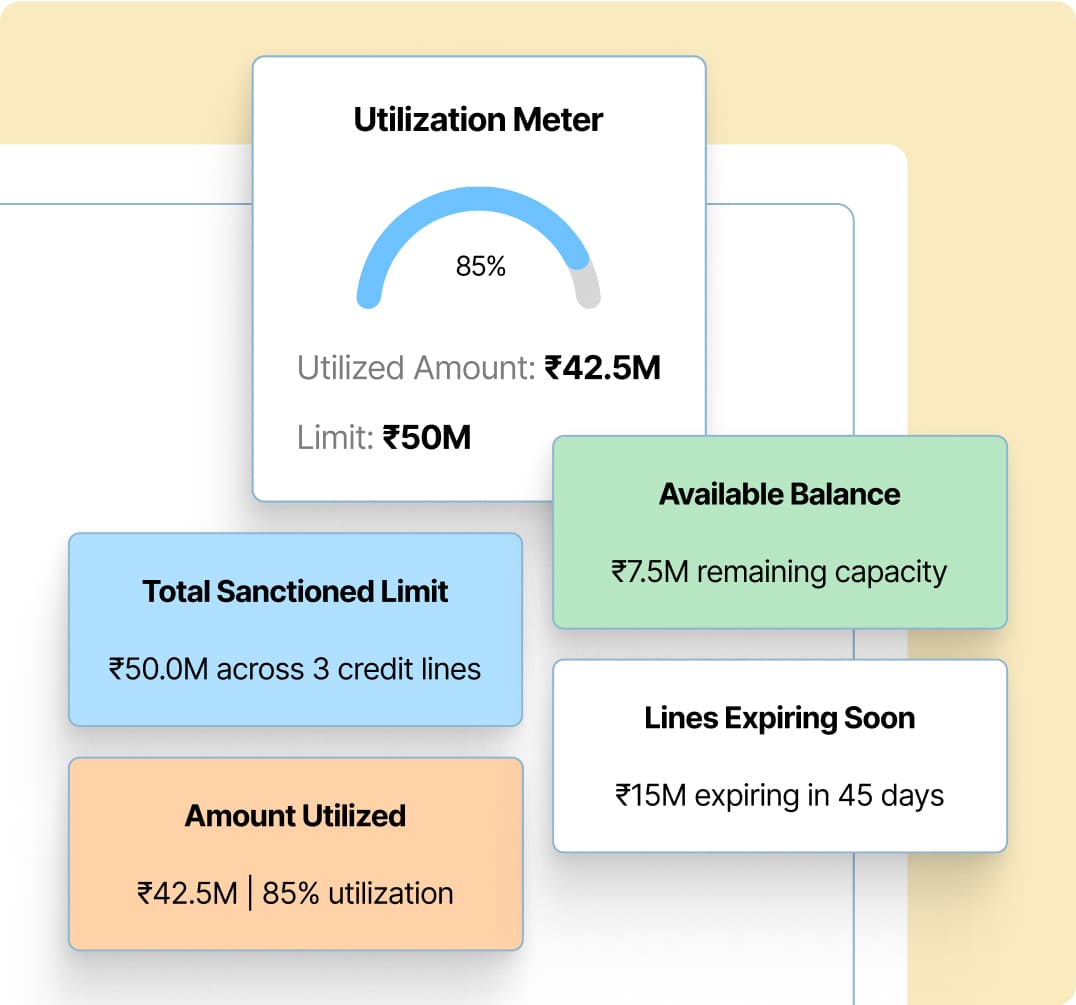

Credit Line & FLDG Operations

Line Details Report

Track credit lines sanctioned with limit utilization, available limits, validity periods, and line status monitoring.

Line Inflows Report

Monitor payments received against credit lines with overflow management and complete transaction tracking.

Lines Expiry Report

Track expiring credit lines with sanctioned amounts, utilized amounts, outstanding balances, and upcoming expiry dates.

FLDG Loans Overdue Data Report

Specialised reporting for FLDG-levied loans showing overdue positions and principal outstanding with DPD tracking.

FLDG Inflows Report

Track overdue and principal outstanding positions specific to FLDG arrangements with complete borrower details.

FLDG Invoked Inflow Transactions

Monitor FLDG invocation transactions with complete inflow tracking by partner and transaction type.

Advanced Analytics & Dashboard Capabilities

Built for Comprehensive Lending Operations

Complete Portfolio Visibility

35+ pre-built reports eliminate reporting gaps and manual compilation, covering every aspect of lending from origination through collections with comprehensive transaction tracking.

Built by Lending Technology Veterans

Developed by tech and product veterans with deep domain knowledge in financial institution reporting requirements and operational analytics.

Regulatory Compliance Ready

Automated credit bureau submissions, trial balance reports, accruals tracking, and writeoff documentation ensure regulatory compliance without manual report generation overhead.

Real-Time Risk Monitoring

DPD tracking, portfolio-at-risk analysis, overdue monitoring, and bucket-wise movement reports enable proactive risk management and early intervention strategies.

Accounting System Integration

Journal entry tracking, trial balance reports, and accruals management integrate seamlessly with accounting software including Tally and OpenGL for accurate financial reporting.

Co-Lending Partnership Management

Specialised co-lending reports provide complete transparency into partnership arrangements with automated reconciliation, split tracking, and portfolio monitoring across all partners.

Trusted by Leading Financial Institutions

Ready to Transform Your Lending Operations?

See how comprehensive reporting and analytics provide complete visibility into every aspect of your lending operations.

Join leading financial institutions who trust Finezza for modern, efficient, and compliant lending solutions.

📞 Call us: +91 22 2611 3242 or simply click below.