Loan Origination System for Modern Lenders

End-to-End Loan Application Processing

Low-code platform for automated loan application processing. Intelligent document verification, real-time credit risk assessment, and streamlined approval workflows with minimal custom development.

Built for Modern Lending Operations

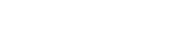

Automatic Document Identification

OCR-based data extraction from KYC documents, salary slips, and financial statements eliminates manual data entry and reduces processing errors.

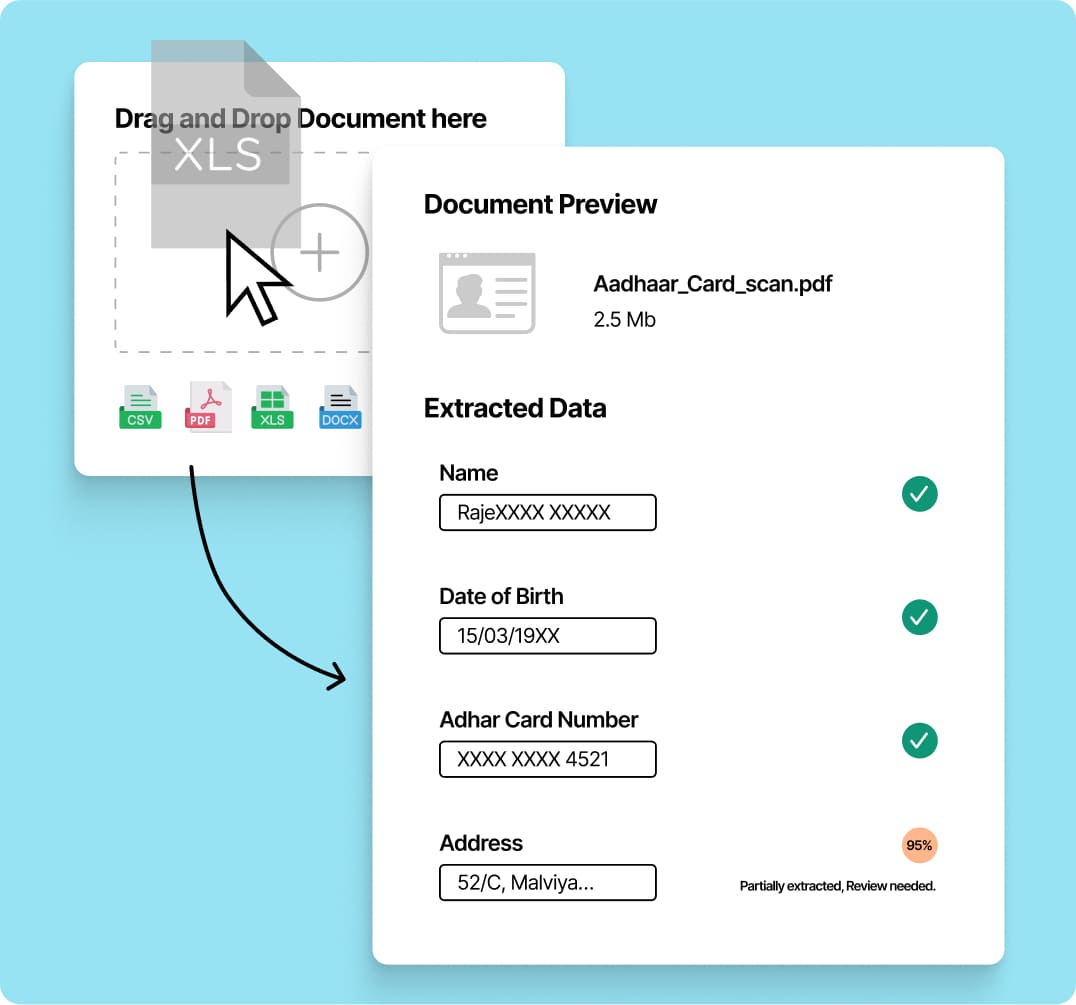

Easy API Integration

Connect with credit bureaus, bank APIs, government databases, and existing systems through our digital-first integration framework.

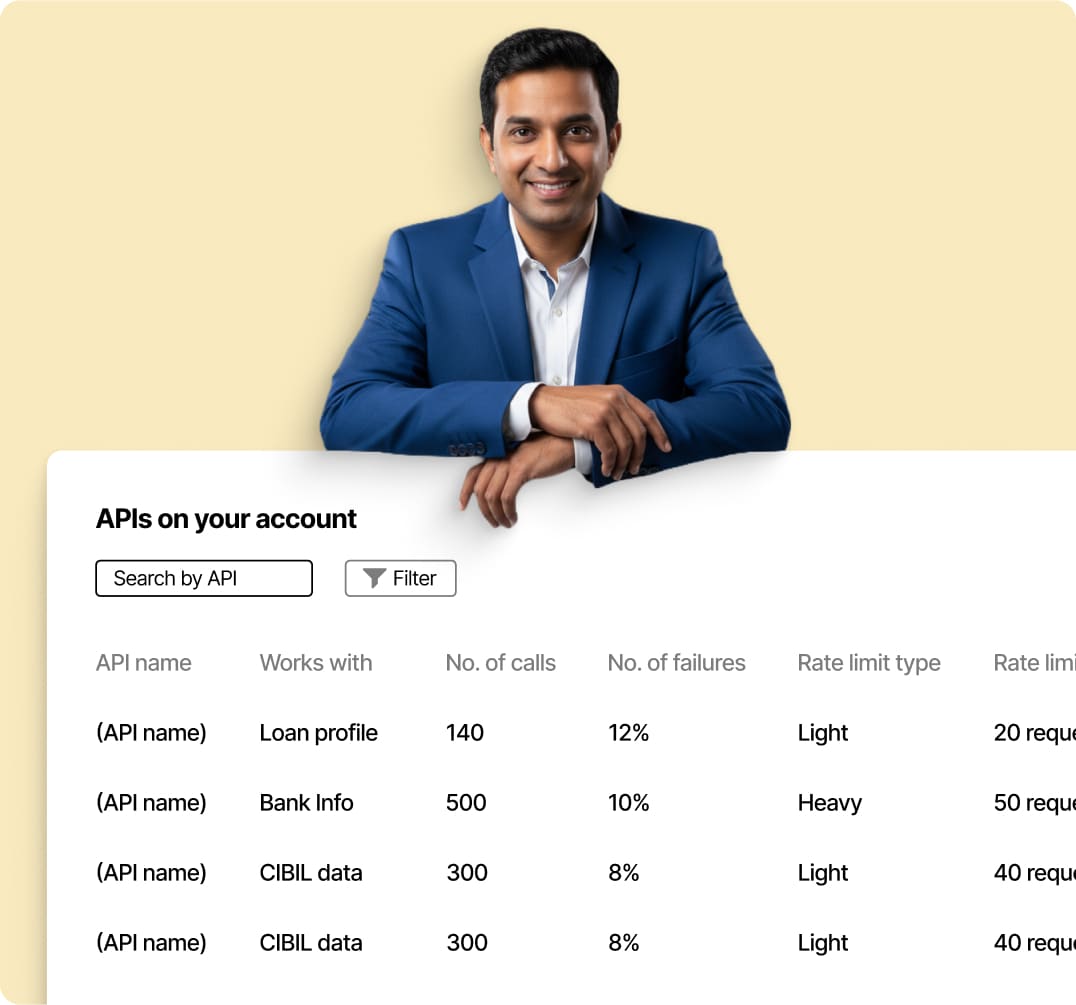

Intelligent Credit Assessment

Multi-layered credit evaluation using bank statement analysis, financial statement analysis, and proprietary scoring models to predict repayment success.

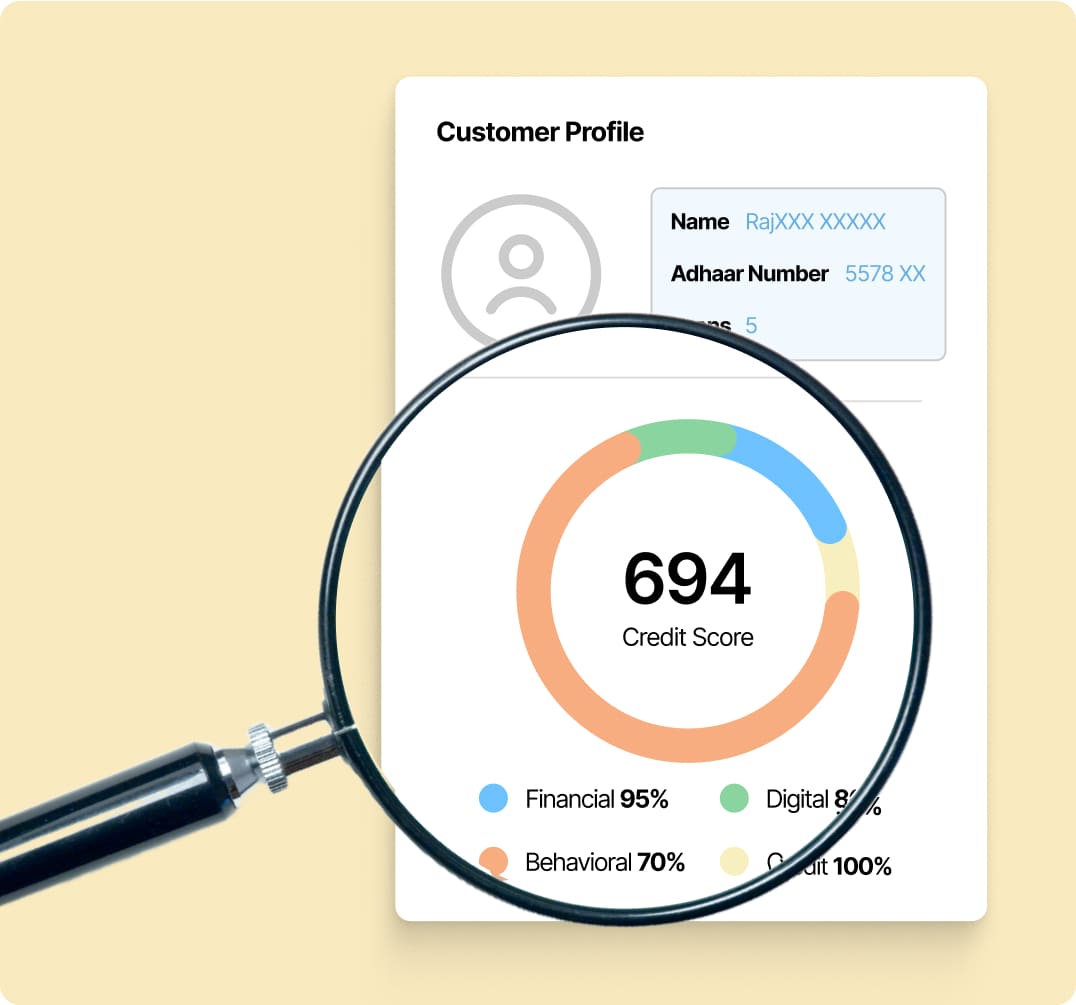

360-Degree Customer Profile Assessment

Comprehensive borrower assessment tracking digital footprints, and financial behaviour patterns across transactions, bank statements, financial parameters, GST, ITR, and credit bureau data for realistic business and personal loan evaluations.

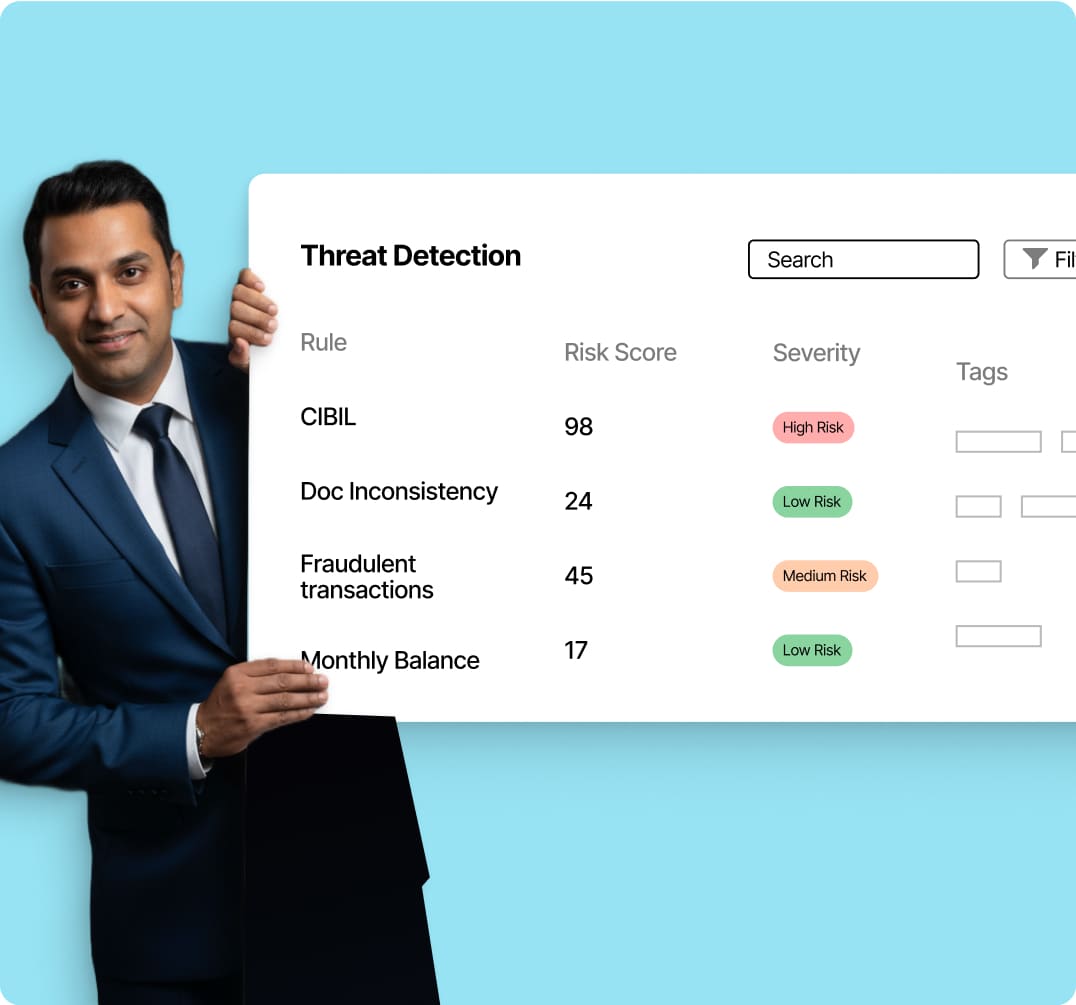

Advanced Threat Detection

Built-in fraud detection automatically identifies suspicious transactions and document inconsistencies during the application process.

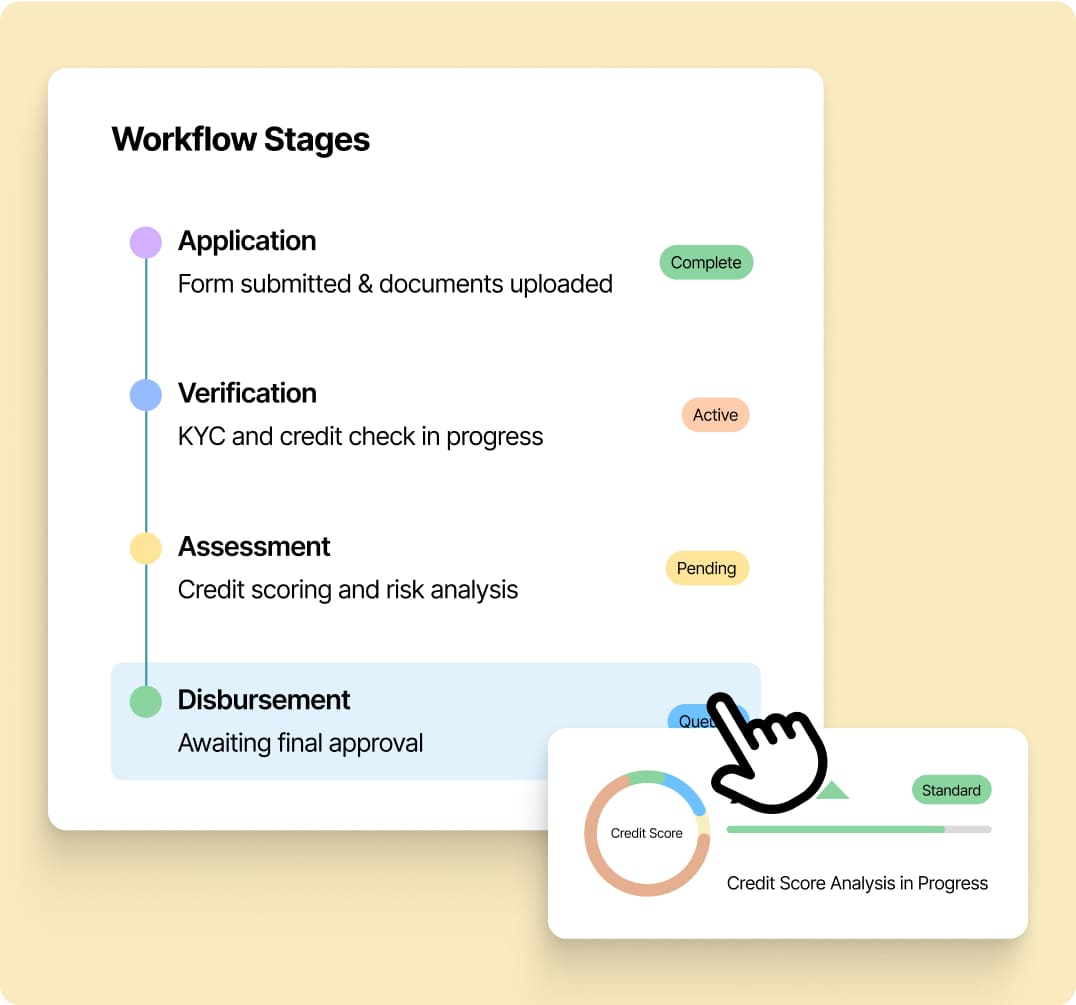

Seamless Workflow Integration

Combines loan origination and management systems into a single, unified flow, ensuring a seamless lending process from application to disbursement.

Works With Your Existing Systems

Handle Any Loan Application

Why Choose Finezza's Loan Origination System

Low-Code Configuration

Minimal custom coding requirements enable quick deployment without extensive technical dependencies for loan application processing.

Eliminate Processing Bottlenecks

Automated document review and OCR-based data extraction eliminate manual data entry, reducing processing time and human errors.

Consistent, Accurate Decisions

Standardised risk assessment across all applications ensures consistent credit evaluation while improving decision accuracy.

Complete Regulatory Compliance

Built-in compliance features with comprehensive audit trails, automated reporting, and adherence to regulatory requirements including RBI guidelines.

Scalable & Customisable Architecture

Handles growing loan volumes without performance degradation while providing tailored solutions that adapt to your specific lending processes.

Enhanced Customer Experience

Real-time application status updates and streamlined approval communications improve borrower satisfaction throughout the origination process.

Trusted by Leading Financial Institutions

Ready to Transform Your Loan Origination Process?

See how our LOS can streamline your lending operations and improve decision-making quality.

Join leading financial institutions who trust Finezza for modern, efficient, and compliant lending solutions.

📞 Call us: +91 22 2611 3242 or simply click below.