Finezza Loan Management System

Complete Lending Portfolio Control

No-code loan management system for efficient tracking and servicing of your entire loan portfolio. Configure loan types, payment schedules, and automated workflows without programming from disbursement to closure.

Core Loan Management System Capabilities

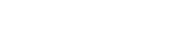

Loan Structure & Types

Multi-Loan Types Support

Handle tenure loans, overdraft facilities, revolving credit, equipment loans, loan against property, and specialised lending products.

Flexible Repayment Frequencies

Configure daily, weekly, fortnightly, monthly payments with principal and interest moratorium options.

Multi-Disbursement Support

Manage single or multiple disbursements with customised schedules for complex loan structures.

Payment Processing

Flexible Payments Module

Process payments through NACH, eNACH, cheques, online transfers, and UPI-based collection methods.

Bank Payment Reconciliation

Seamless reconciliation across all payment modes with automatic matching and exception handling.

Configurable Waterfall Audits

Specify the exact order of payment allocation across different heads (principal, interest, fees, charges).

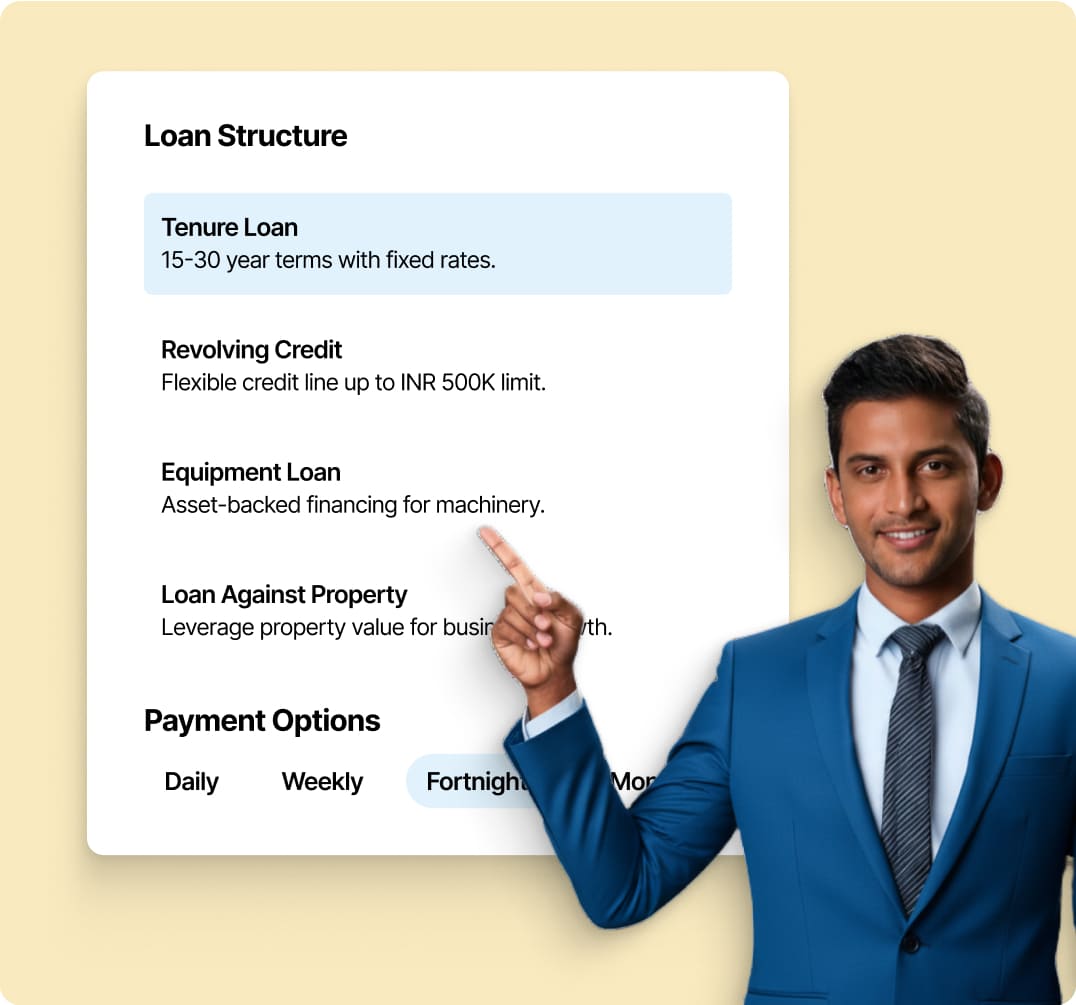

Documentation & Compliance

Dynamic Loan Document Generation

Create and customise loan agreements, repayment schedules, and other documents using built-in templates.

Bureau Reporting

Generate automated reports for all credit bureaus with standardised data formats.

Accounting Software Integration

Direct integration with accounting systems for balance sheet and P&L reporting.

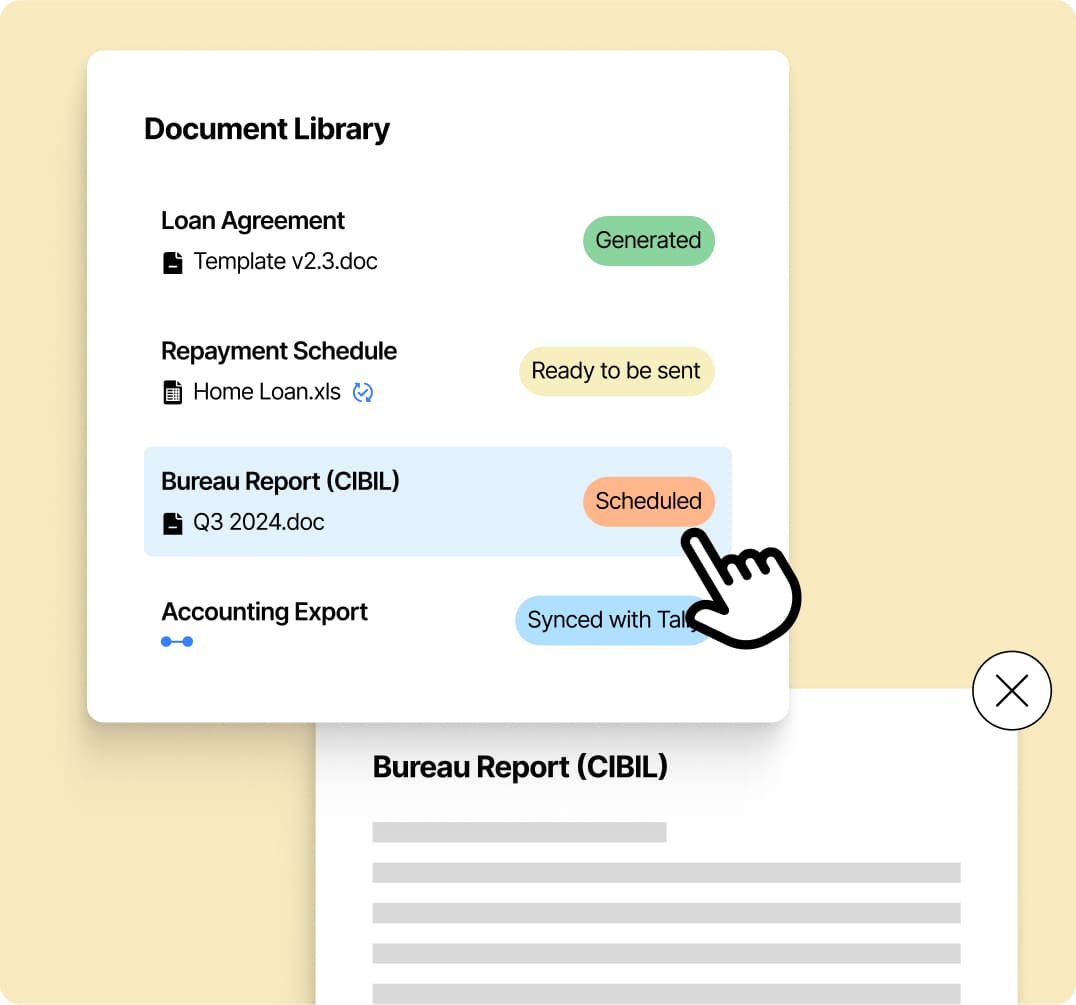

Portfolio Management

NPA Management

Proactive monitoring and classification of loans with early warning indicators and automated escalation.

Waivers Management

Identify eligible charges for waiver and process approvals through configurable workflows.

Restructuring of Loans

Handle loan restructuring requests with automated recalculation of schedules and terms.

Settlements & Write-offs

Process settlements and write-offs with proper authorisation workflows and audit trails.

Provisions Management

Flexible provision calculation and management based on loan performance and regulatory requirements.

Operations & Communication

Collections Management

Complete collection assignment, tracking, and reconciliation with field team coordination.

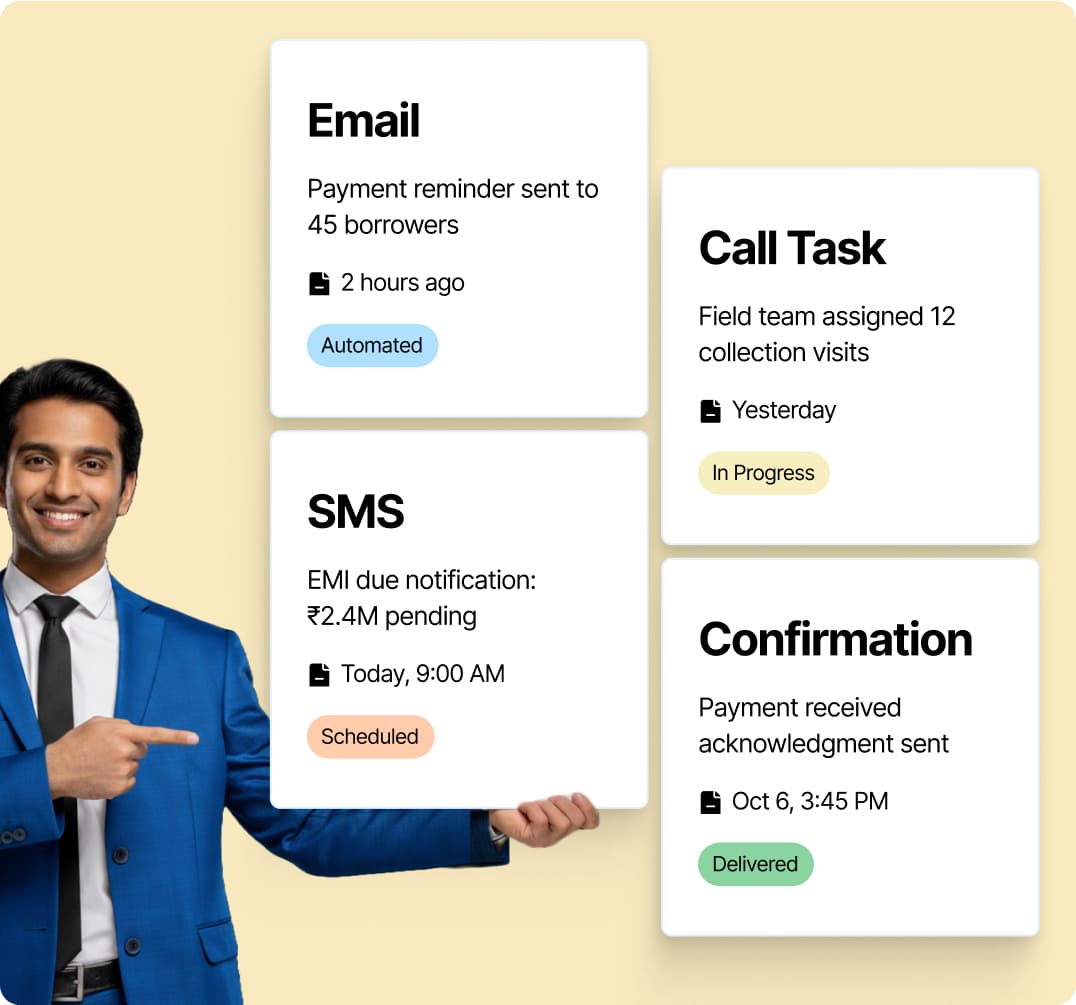

Effective Loan Communication Management

Automated EMI reminders, payment confirmations, and customer communication across multiple channels.

Why Choose Finezza's Loan Management System

No-Code Configuration

Manage entire lending pipeline through intuitive interfaces without programming or technical dependencies.

Comprehensive Portfolio Handling

Manage diverse loan types with flexible repayment structures, automated processing workflows to reduce manual processes.

Built by Lending Technology Veterans

Developed by tech and product veterans with deep domain knowledge in financial institution loan servicing operations.

Regulatory Compliance

Built-in compliance features with comprehensive audit trails, automated bureau reporting, and adherence to regulatory requirements.

Operational Efficiency

Automated EMI processing, payment reconciliation, and collection management eliminate operational bottlenecks and improve portfolio performance.

Complete Integration

Seamless integration with loan origination, collection systems, and accounting software for unified lending operations.

Trusted by Leading Financial Institutions

Ready to Transform Your Lending Operations?

Join leading financial institutions who trust Finezza for modern, efficient, and compliant lending solutions.

Simply talk to our team about your specific challenges.

📞 Call us: +91 22 2611 3242 or simply click below.