Comprehensive Integrations by Finezza

Works With Your Existing Systems, Seamlessly!

Extensive integration ecosystem connecting Finezza with credit bureaus, payment systems, banks, government databases, and business tools.

No need to replace your existing technology - we connect with what you already use.

List of Supported System Connections

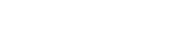

Credit Assessment & Verification

Credit Bureaus

CIBIL, CRIF, Experian, Equifax for comprehensive borrower credit assessment.

Bank Statement Analysis

Perfios, ScoreMe, Precisa for automated financial analysis and income verification.

Identity Verification

Karza, Signzy, IDfy, Probe42 for KYC automation and borrower verification.

Government Data

Aadhaar, GSTN, Udhyam, CKYC, Cersai, NSDL for official data verification and compliance.

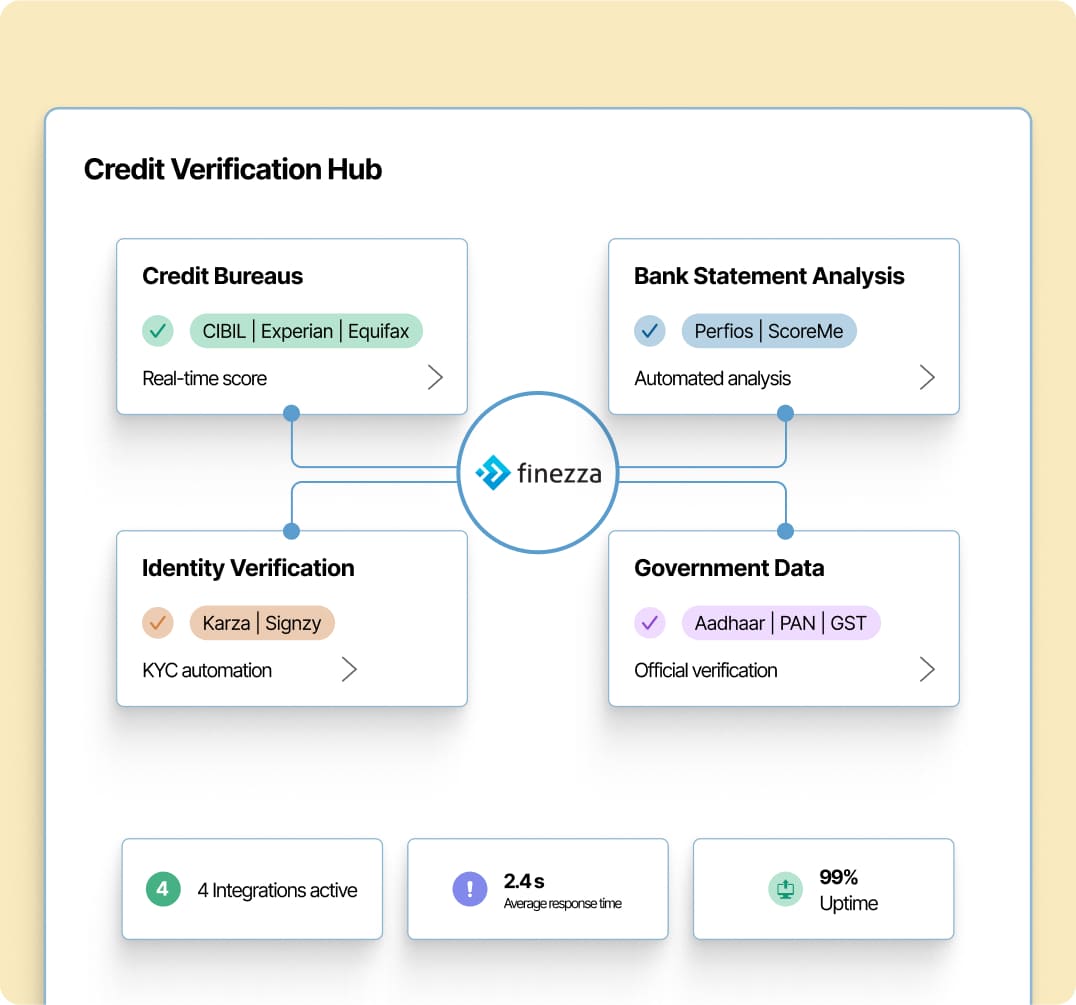

Payment & Banking Systems

Payment Gateways

RazorPay, PayTM, PayU, CashFree for digital payment processing and collection.

Payment Methods

UPI, GooglePay, PhonePe, NACH, eNACH, pNACH for diverse payment collection options.

Banking APIs

ICICI, IDFC, Yes Bank direct integration for disbursements and account operations.

Disbursement Systems

RazorPayX and bank disbursement APIs for automated loan fund transfers.

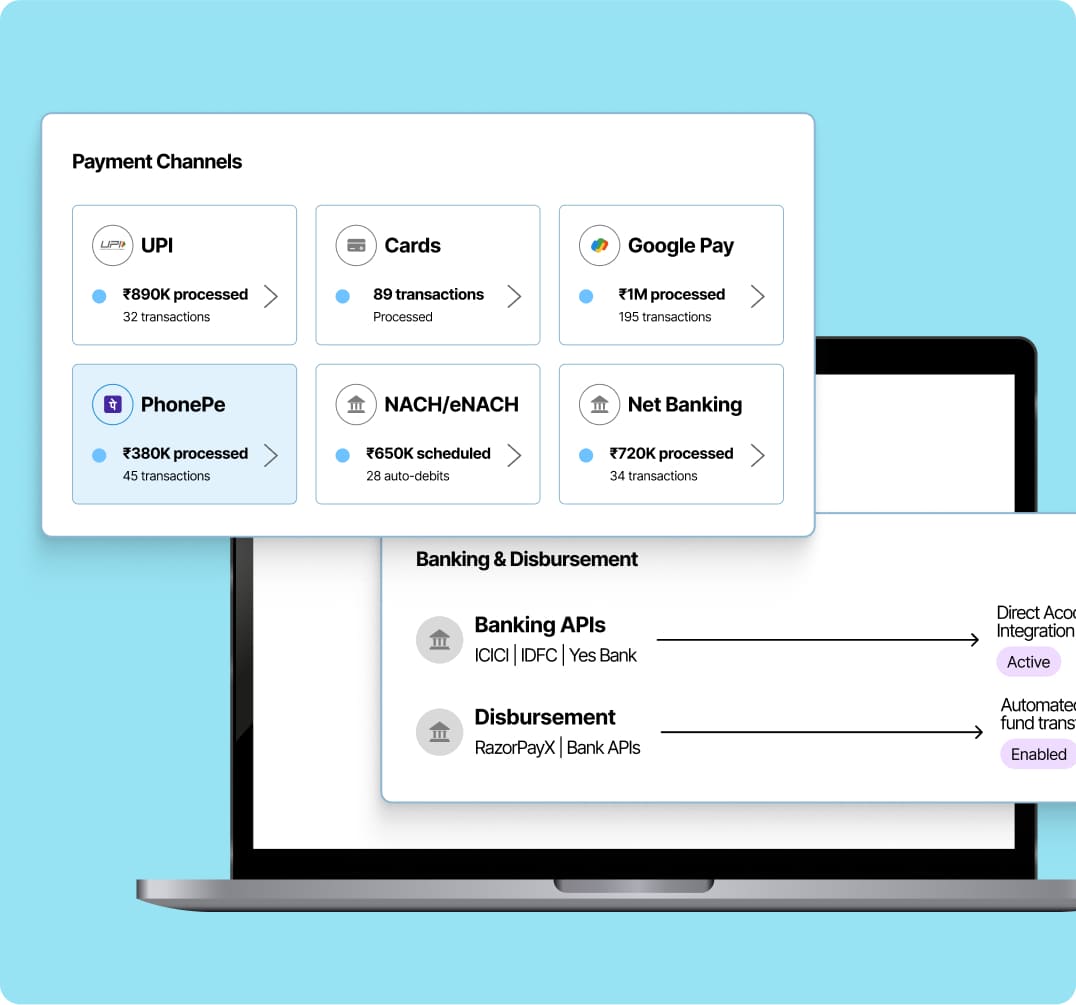

Documentation & Compliance

eSign Providers

Digio, Signzy, Leegality for digital document signing and loan agreement execution.

Document Processing

Karza, DICE for automated document extraction and data capture from uploaded files.

Government Integration

NSDL, GSTN verification systems for business compliance and tax data validation.

Document Verification

PEP screening, vKYC for enhanced due diligence and regulatory compliance.

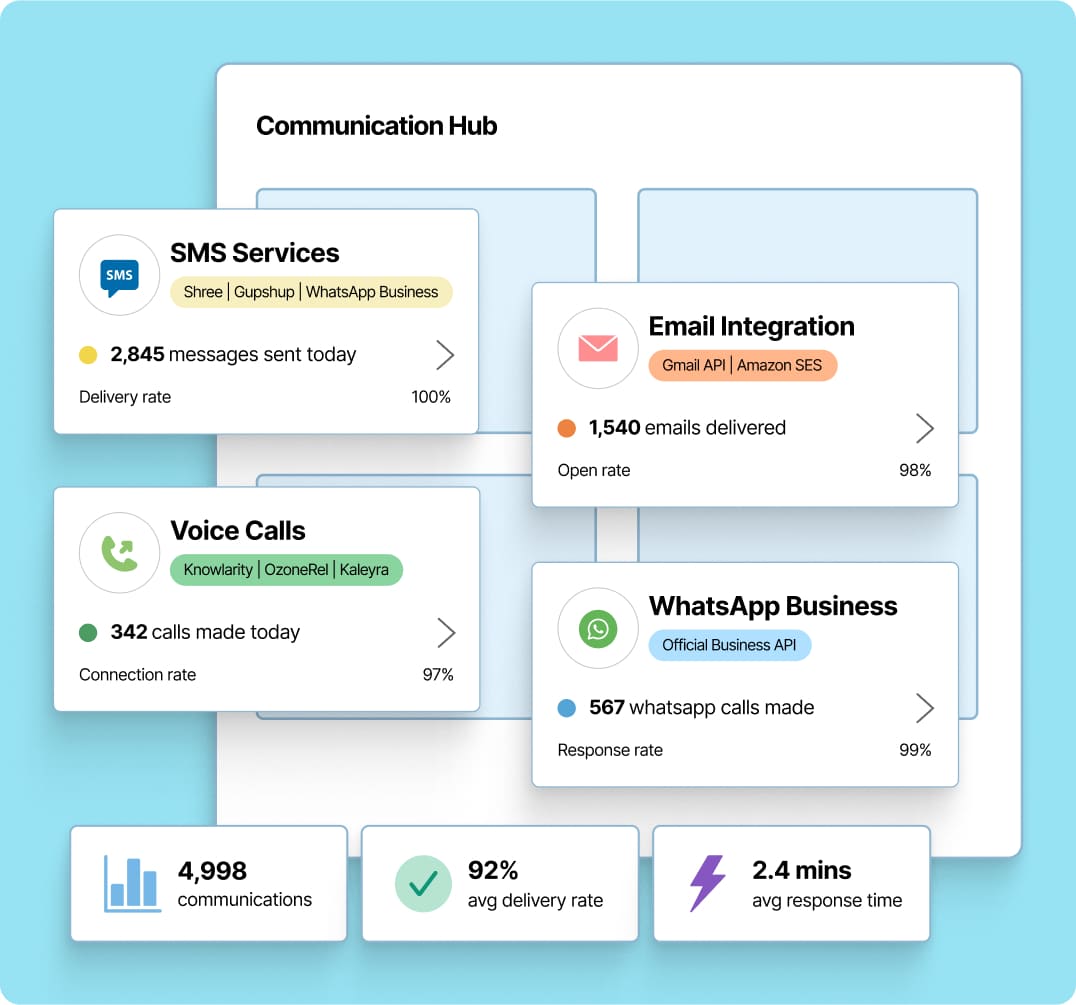

Communication & Engagement

Messaging Services

SMS (Shree, Gupshup) and WhatsApp Business API for customer communication and notifications.

Email Integration

Gmail, Amazon SES for automated email communications and document delivery.

Cloud Telephony

Knowlarity, OzoneTel, Kaleyra for call management and customer interaction tracking.

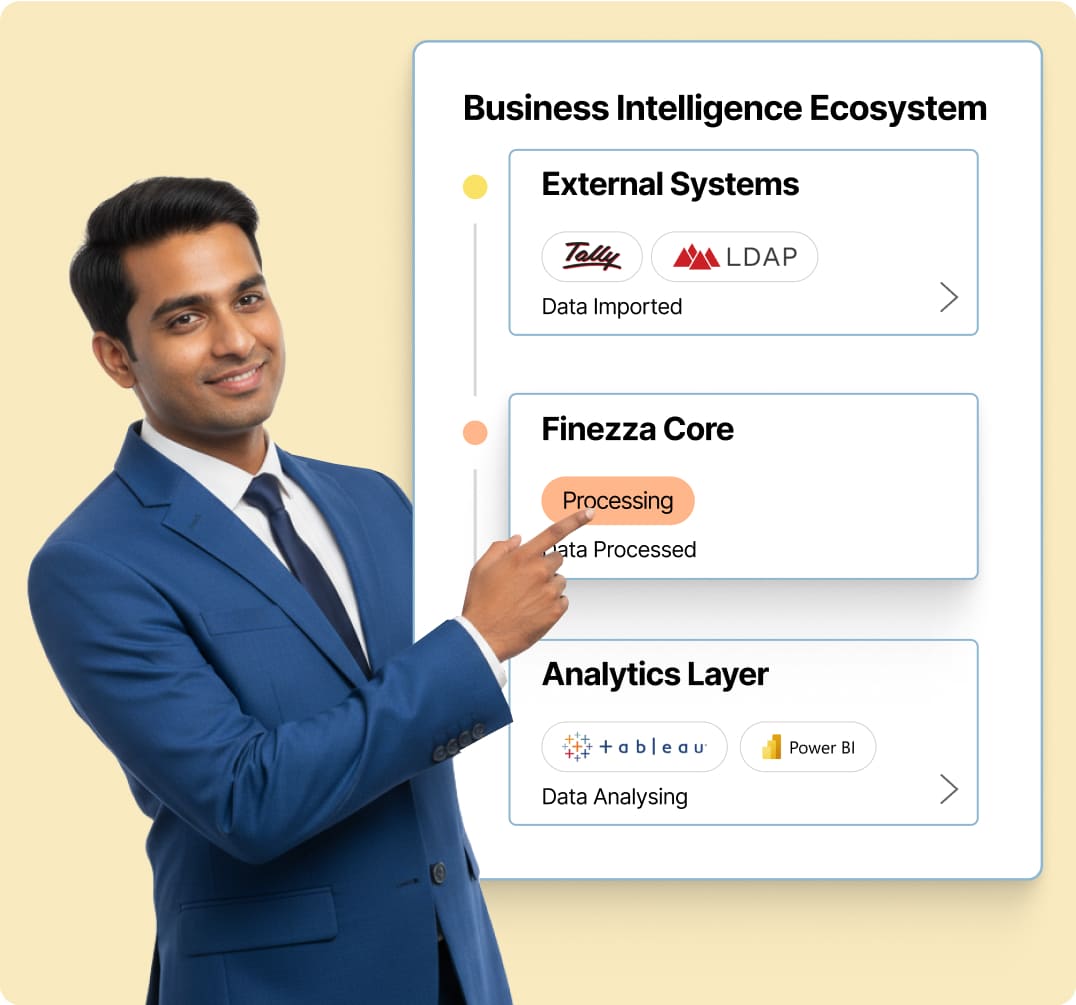

Business Systems & Analytics

Business Intelligence

Tableau, Kibana, PowerBI integration for advanced portfolio analytics and visualisation.

Accounting Software

Tally, OpenGL connectivity for financial reporting and bookkeeping integration.

System Authentication

LDAP, SSO, ZTNA for secure user authentication and access management.

Data Processing

Various MIS and ERP connectivity for enterprise resource planning integration.

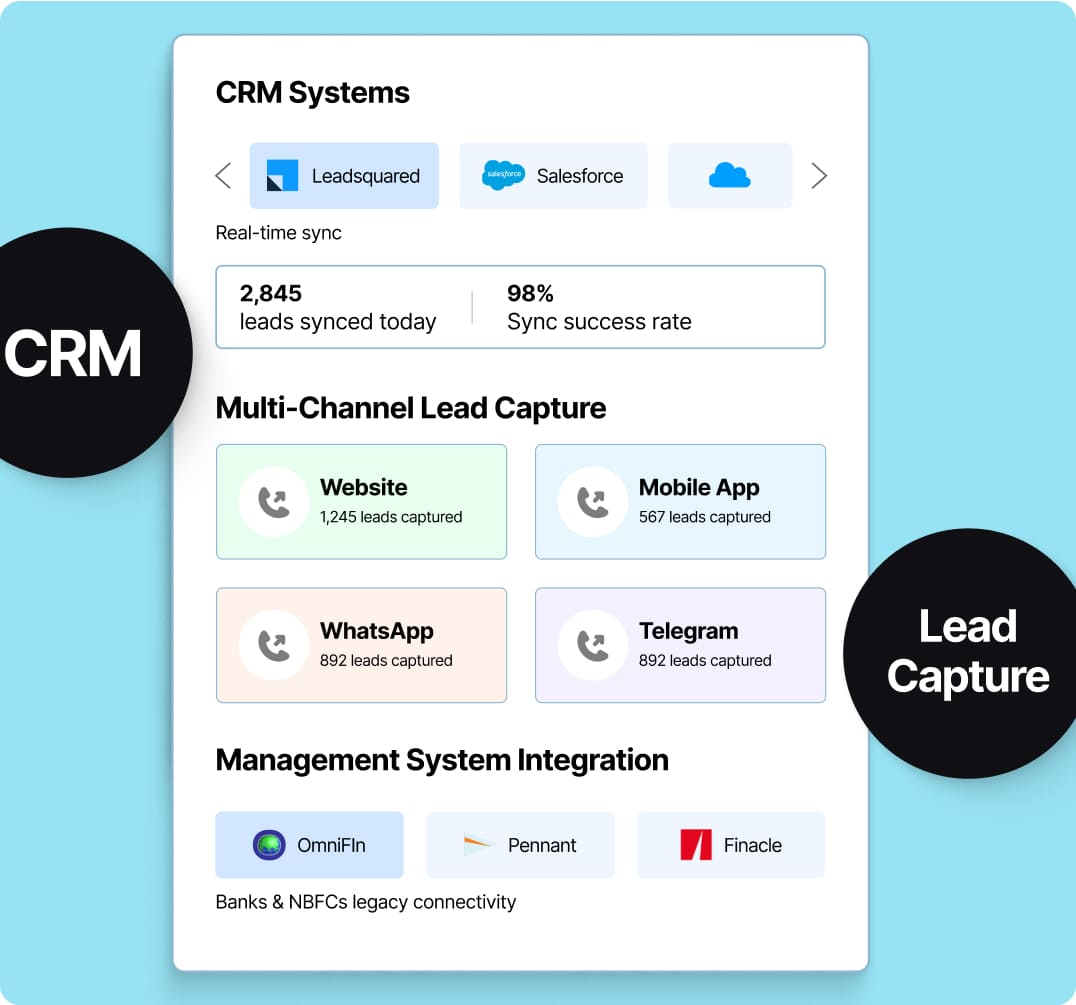

CRM & Lead Management

CRM Systems

LeadSquared, SalesForce integration for lead management and customer relationship tracking.

Lead Processing

Web, mobile, WhatsApp, Telegram integration for multi-channel lead capture.

Existing LMS Integration

OmniFin, Pennant, Finacle connectivity for banks and NBFCs with legacy loan management systems.

Why Comprehensive Integration Matters

Proven Integration Expertise

Established Partner Network

Pre-built integrations across credit bureaus, payment systems, government databases, and business tools eliminate custom development requirements for standard connections.

Platform-Agnostic Approach

Integration framework designed to work with existing technology infrastructure without requiring major system changes or operational disruption.

Secure System Connectivity

All integrations built with enterprise-grade security protocols, ensuring data protection and regulatory compliance across connected systems.

Comprehensive Coverage

Integration ecosystem spans the complete lending lifecycle from customer acquisition through loan closure and portfolio management.

Proven Implementation

Successful integration deployments across various lending institutions provide tested frameworks for reliable system connectivity.

Ongoing Integration Support

Continuous maintenance and updates for partner integrations ensure long-term compatibility and optimal system performance.

Trusted by Leading Financial Institutions

Ready to Transform Your Lending Process?

Discover how Finezza's proven integration ecosystem enhances your existing technology while providing comprehensive lending platform capabilities.

Join leading financial institutions who trust Finezza for modern, efficient, and compliant lending solutions.

📞 Call us: +91 22 2611 3242 or simply click below.