Complete Lending Lifecycle Management Platform for

Banks NBFCs Fintech Companies

Streamline loan origination, lending management, and collections with our AI-powered software platform and seamless integrations.

Reduce loan processing time significantly while minimising credit risks.

Trusted by Leading Financial Institutions

Products

End-to-End Lending Solutions

Everything you need to manage for the modern lending – from origination to collections.

Loan Origination System

Low-code loan origination platform. Process applications faster with automated document checks and smart risk scoring. No more weeks-long approval cycles.

Learn moreLoan Management System

No-code loan management platform with complete loan lifecycle tracking, portfolio management, and automated workflows you can configure without programming.

Learn moreCollection & Delinquency Management

AI-powered collection workflows with real-time communication tracking and payment reminders.

Learn moreCollection & Delinquency Management

AI-powered collection workflows with real-time communication tracking and payment reminders.

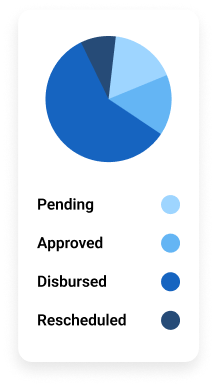

Learn moreReporting & Analytics

Real-time dashboards, automated bureau reporting, and business intelligence integration for complete lending portfolio visibility.

Learn moreReporting & Analytics

Real-time dashboards, automated bureau reporting, and business intelligence integration for complete lending portfolio visibility.

Learn moreFinezza Works With Your Existing Systems, Seamlessly

Connect to the existing tools and services your business uses.

No need to change everything at once.

Integrations Supported

Credit Bureaus

CIBIL, CRIF, Experian, Equifax

Payment Gateways

Paytm, RazorPay, GooglePay, PhonePe, UPI

Banking APIs

ICICI, IDFC, and 15+ major banks

eSign & KYC

NSDL, Aadhaar KUA, Digio, Signzy, IDfy

Loan Types Supported

From MSME loans to personal credit, our platform adapts to your lending business requirements.

Business Lending

MSME Loans, Corporate Lending, Supply Chain Financing, Invoice Discounting

Personal Finance

Personal Loans, Education Loans, Gold Loans, Payday Loans

Asset Financing

Vehicle Loans, Property Loans, Equipment Financing, Machinery Loans

Digital Credit

Virtual Credit Cards, Overdraft Products, Flexi-Credit Solutions

Why Us

Why Leading Lenders Choose Finezza

Everything you need to manage for the modern lending – from origination to collections.

Complete Lifecycle Management

Manage the entire lending lifecycle journey from loan origination, servicing, collections, and analytics, with integrated workflows and automated processes.

AI-Powered Risk Assessment

Reduce NPAs with intelligent credit analysis, bank statement analytics, and predictive scoring models.

Quick Implementation

Platform-agnostic solution with secure APIs and data pipelines that integrate with your existing systems in weeks, not months.

Quick Implementation

Platform-agnostic solution with secure APIs and data pipelines that integrate with your existing systems in weeks, not months.

Regulatory Compliance

Built-in compliance features with audit trails, automated reporting, and adherence to RBI guidelines and industry standards.

Regulatory Compliance

Built-in compliance features with audit trails, automated reporting, and adherence to RBI guidelines and industry standards.

FAQ

Frequently asked questions:

Everything you need to know about Finezza.

-

What types of lending institutions can use Finezza?

Finezza is ideal for all banks, NBFCs, fintech companies, and other lending institutions of all sizes. Our platform supports various lending models from traditional banking to digital-first lending, handling everything from personal loans to complex commercial financing products.

-

How does Finezza integrate with our existing systems?

Finezza offers comprehensive integration capabilities with credit bureaus (CIBIL, CRIF, Experian, Equifax), payment gateways (RazorPay, Paytm, UPI), banking APIs, accounting systems (Tally, OpenGL), and eSign providers. Our platform-agnostic approach connects with your current technology without requiring complete system replacement.

-

What loan types does the platform support?

Our lending management system handles all major loan categories including MSME loans, personal loans, vehicle financing, home loans, gold loans, education loans, supply chain financing, and digital credit products like virtual credit cards and overdraft facilities.

-

Is Finezza compliant with RBI guidelines and banking regulations?

Yes, Finezza is built with comprehensive compliance features including audit trails, automated reporting, and adherence to RBI guidelines and industry standards. The platform includes regulatory reporting capabilities for credit bureaus and government authorities.

-

Can we customise Finezza for our specific lending processes?

Finezza has been built iteratively to provide customised solutions for different lending approaches. The platform adapts to your specific business model, loan products, and operational workflows while maintaining core functionality across all lending processes.

-

How do we get started with implementing Finezza?

Implementation begins with understanding your specific lending requirements and existing system architecture. Our team provides consultation to map your processes and plan the integration approach that works best for your institution's operational needs.

-

Does Finezza's LOS and LMS implementation require tech expertise?

Finezza Loan Origination System is a low-code platform requiring minimal custom development for configuration and workflow setup. What's more, our tream provides all the support you need for the perfect Finezza integration with your systems.

Our Loan Management System is completely no-code, meaning you can configure loan products, payment schedules, and operational workflows through intuitive interfaces without any programming knowledge or technical dependencies. -

Can Finezza alone really handle the entire loan origination and loan management effectively?

Many lenders assume they need separate LOS and LMS solutions because most vendors specialise in either origination or servicing. Finezza is designed differently - it can handle the complete lending lifecycle from application processing through loan closure in one integrated system. This eliminates data handoffs between systems, reduces operational complexity, and provides unified reporting across your entire lending operation.

Ready to Transform Your Lending Operations?

Join leading financial institutions who trust Finezza for modern, efficient, and compliant lending solutions.

Simply talk to our team about your specific challenges.

📞 Call us: +91 22 2611 3242 or simply click below.